Get Good With Money Challenge – Day 4: Income Boost Bootcamp

Today’s Easy Financial Task: Get Good With Income

How to rock this task:

1. Video Lesson

2. Explore 9-5 Boosts

3. Explore Side Hustle Boosts

4. Dream Catcher High-Five

5. Debt Reduction To Earn More

6. Get Good With Money Plan

Welcome to Day 4 of the Get Good With Money Challenge! Woo-hoo, over halfway there…

There are two ways you can increase the amount of money available to you - you can either spend less or make more.

You learned some ways to spend less in yesterday's lesson.

That was awesome!

Buuuut, I don’t want you to get caught in a cycle of trying to squeeze blood out of a turnip -where you cut and cut and cut your spending and still end up without enough to sustain yourself and ENJOY life.

So, let’s use STRATEGY to determine how to bring in more money as needed.

1. VIDEO BREAK 🍿🥤

Please pause to watch a breakdown of three rules to follow to increase your income.

Now, it's time to break things down in more detail...

Have a traditional 9-5? Let's start there (if not, still read this section…maybe you can share these tips with someone who does).

2. How To Maximize Your Income At Your Job

Be Ready To Ask For A Raise

Given the economy and your occupation, right now may (or may not) be the best time to ask for a raise.

But, you should ALWAYS be ready for when the opportunity to do so does present itself.

Here’s how:

1. Use a website like Glassdoor, Indeed, or Payscale to see if you can find a national average for your job. How does your salary compare to the average?

2.Support any raise chats with what I like to call a “brag book”.

A brag book is a place where you’re going to document anything awesome you do at work.

The wins you want to keep track of will vary based on your job but could include any improvements you’ve made to the workflow, budget, or sense of community... and especially anything you’ve done to help save or make money for your company.

You want to draw attention to the things that make you shine! ✨

Tiffany Tip: Use numbers when you can. How much has each brag book entry made or saved the company, directly or indirectly?

Remember: Men lie, women lie…but numbers don’t.

3.Start bragging!

Use this FREE >> BRAG BOOK TEMPLATE << to begin thinking about some of the ways you’ve positively impacted your employer and/or place of employment and jot them down.

Skillset Boost

Expanding your skills is another way to enhance your value to your company. This might mean taking classes or seeking a professional designation or certificate.

First, see if your company will cover the cost of any training or education before reaching in your own pocket.

And, do your research to ensure the said training has the potential to be worth the time, effort, and money.

Got it? Good!

Now, let’s move on to alternate income by way of side hustles and other gigs.

3. Maximize Your Side Hustle Game

Again, we’ll use strategy to get the most bang for our buck.

Assess Your Skills

Before you sink money into learning anything new or buying products to sell in a hot now/cold later scheme, take inventory of YOU(r) own skills and talents first.

Use this list of questions to help you brainstorm and write down your list of skills:

What do I find myself doing in my spare time?

What do people come to me regularly for?

What comes to me easily?

What did I want to be when I was younger?

Bonus Step: Seek outside input. Ask a friend, family member, or coworker: What would you say I’m good at?

Now that you have your list of skills, it’s time to decide which of them you can monetize.

Here’s the plan...

Consider Your Current Skill Set First

Why reinvent the wheel? Your current job skills can be the foundation for a lucrative side hustle. Not only is it a smooth transition, but your expertise will allow you to command higher rates.

Some examples:

Keisha, an HR specialist, helped people develop resumes and prepare for job interviews

Tiffany, a teacher, babysat and tutored within her community (that’s me - true story)

Open up an internet browser and type in your job title followed by “side hustles” and see what ideas it sparks.

Supercharge Your Current Skill Set

To make the largest amount of money out of your side hustle, you may consider ways to enhance your current expertise.

To use myself as an example again, I eventually got my master’s in education, which allowed me to both make more as a teacher and increase my tutoring fee.

In fact, I was able to command twice as much as tutors who didn’t have their master’s.

Before you proceed with adding any fancy new titles, carefully research the potential return on investment. Ensure that the increased earnings justify the cost and time commitment.

Set Limits On Your Cash Output

I could write a book on this alone, but here’s the gist. Focus on the MONEY first -the things that bring you a direct return on your money.

Let me give you an example.

Direct Return: If a baker starts a business, they will need to buy flour, sugar, eggs, baking powder, and other ingredients.

Indirect Return: The same baker would be putting the cart before the horse by also immediately investing in retail rental space and gourmet equipment.

That can all come later… after the money starts coming in.

Calculate The Income Potential

Once you’ve gotten clear on your monetizable skill(s), you want to determine how much your side gig can realistically bring in each month.

Look up what other people in your area are charging for similar services.

See if there are unique spins you can put on your offerings to stand out from the crowd

Get yourself out there! Don’t spend two years “getting ready” to launch.

To make it REALLY real, let's set a date to start earning more.

I will start monetizing my _________ [insert skill set] on _______ [insert date].

JUST. DO. IT.

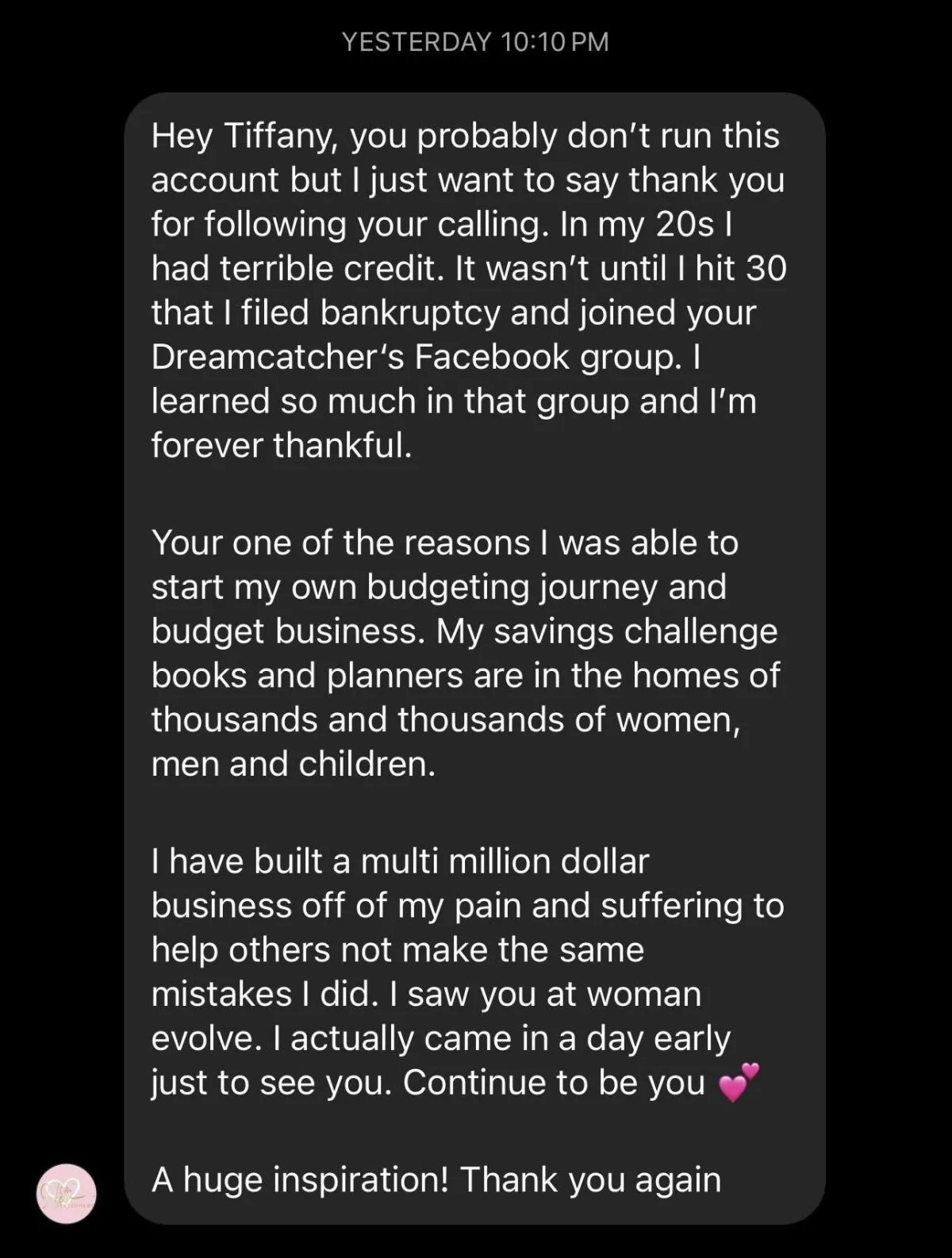

4. Dream Catcher High-Five ✋🏿 (Tiffanie ~ From Broke With "Bad" Credit To Multi-Millionaire)

Do you think you don't have the power to shift your financial trajectory? Issa LIE!

Facing bad credit and financial hardship, Tiffanie made a powerful decision: to get good with money, for good.

She boosted her credit score by an incredible 200 points and, in the face of a 2020 job loss, launched a side hustle that transformed into a multi-million dollar empire, landing her features on Good Morning America and beyond.

And, I had NO IDEA the life-changing impact my trainings and resources had on her... until she sent me a message.

READ IT HERE...

Whew, I hope you are as inspired as I am!!!!!! * tears *

It is GOING to happen for you because you are DOING the work.

Are you ready for me to break down a rarely mentioned way for you to earn more?

Let's talk about it...

5. Debt Reduction To Earn More

Want a "raise" without the boss's approval? Work to slash your debt.

Think of it this way: every dollar you spend on debt payments and interest is a dollar you DON'T have to spend on yourself.

By minimizing debt, you free up that money, effectively giving yourself a "raise"

You have more money to invest in your future, pursue your passions, or simply enjoy life.

Feeling Overwhelmed By Debt Or Other Financial Stressors?

I have a great resource for you -a non-profit that has been providing free or low-cost debt management help and hope to clients since 1951 (yes, 70+ years!).

Whether it's student loans, credit cards, or a temporary setback, the National Foundation For Credit Counseling (NFCC) can help.

Connect for a FREE session (generally 30 mins- 1hr) with a certified credit counselor to gain clarity and develop a personalized plan to tackle your debt—no loans, hidden fees, or hassle.

NFCC Can Help:

-Stop collection calls

-Consolidate bills into smaller monthly payments

-Lower interest rates regardless of credit score

-Eliminate late fees and over the limit charges

-Pay off your debt faster

-Improve your money habits

-Provide small business finances support

-Provide military or Veteran family support

-Provide student loans support

And more...

Money IS a team sport! You got this...

And, congratulations on the strides you made today.

Please Let me know in our >> private community << if you started filling out your Brag Book and/or identified some money-making side hustle opportunities?

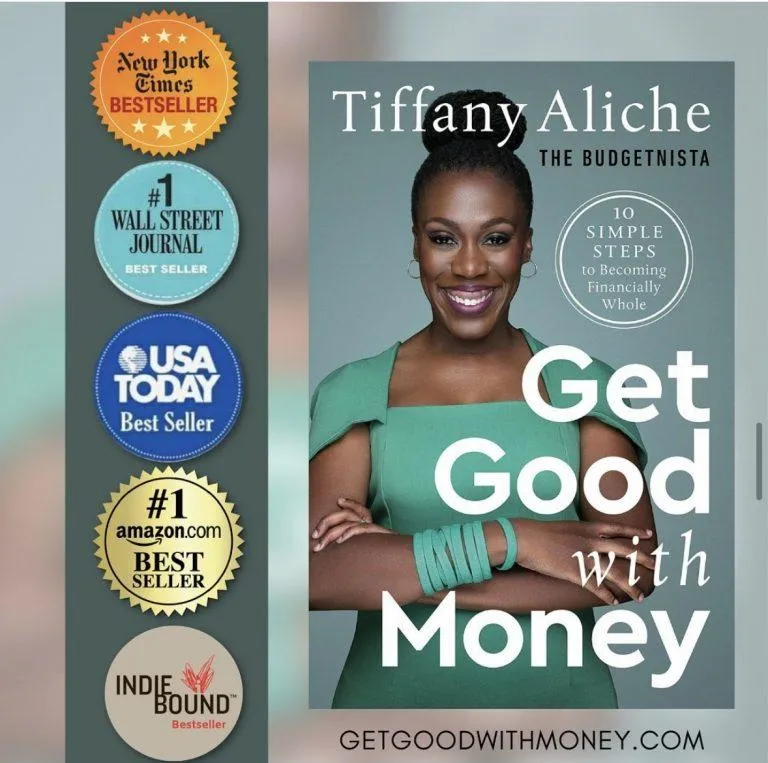

6. Get Good With Money Plan Access

Remember, this is just the beginning of your financial journey. The Get Good With Money Plan (my brand-new immersive 14-module video training program) is the proven system I used to go from $225k in debt to building generational wealth.

You'll have the opportunity to tackle budgeting, debt, investing, insurances, retirement planning, estate planning, and so much more, with me and my team of 10 personal money coaches.

As a challenge participant, you get an unbelievable 40% OFF discount if you join us right now (your discount is automatically applied on the page).

Regular Get Good With Money Plan Price: $549

Challenge Participant Price (40% OFF): $297

This is the lowest price the Get Good With Money Plan will ever be!!!!!!!

You're already on the right path. You've learned about just a few of the folks (there are hundreds of thousands) who turned their financial life around hanging with "The Budgetnista" (that's me, lol).

Don't stop now...

See you tomorrow.

Live richer,

Tiffany

FOLLOW US ON SOCIAL

My Lisa Rule: I have 4 sisters and Lisa is the baby (well she’s not a baby anymore). Of all of my sisters, I’m the most protective over her. Before I share any product or service with you, it must pass my Lisa Rule.

What’s the Lisa Rule? If I would not advise Lisa to use a product or service, I won’t advise you to either. YOU are my Lisa's. I feel protective over you and your financial journey.

The products and services I recommend pass my Lisa Rule. Yes, I may be an affiliate or partner and earn a commission off of referrals or income, but I would not recommend a product or service that I didn’t believe was helpful and useful.

FOLLOW US ON SOCIAL

TOOL OF THE DAY