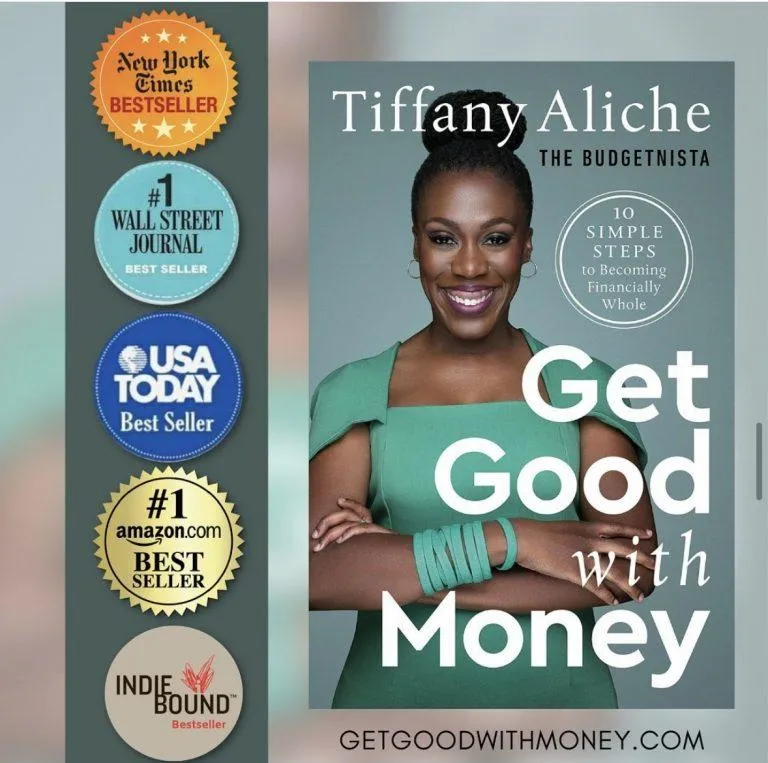

Get Good With Money Challenge – Day 3: The Credit Blueprint

Today’s Easy Financial Task: Get Good With Credit

How to rock this task:

1. Credit 101

2. Credit Score vs Credit Report

3. Ways To Boost Your Credit

3.5 Dream Catcher High-Five

4. BONUS (100 Points HACK!)

5. Video Lesson

6. Get Good With Money Plan

7. LIVE CLASS Tonight (1/8) @ 8PM ET HERE

Today is Day 3 of the Get Good With Money Challenge and before you think I've just had this perfect road to personal finance success...

Let's talk about my financial fails. Yeah, you read that right - fails.

I've been there, done that, and got the t-shirt (or rather, the credit card debt).

At 24, I made a terrible decision that led to $35,000 in debt. And just when I thought things couldn't get worse, the Great Recession hit, and my credit score plummeted.

But I didn't give up. I learned from my mistakes and turned my financial life back around.

Now it’s time for me to walk YOU through some of the most useful tips and tricks I've learned that will help you along your credit journey.

Let’s go!!!!

1. What is Credit? A Simple Explanation

Imagine borrowing a book from a friend. You promise to return it later. This is a simple form of credit.

In financial terms, credit is the ability to borrow money or goods and pay for them later.

When you use credit, you're essentially borrowing money from a financial institution or lender.

You agree to pay back the borrowed amount, often with interest.

The interest rate is the cost of borrowing money.

Why do we need credit?

Big Purchases: Buying a car or a house often requires borrowing money.

Everyday Expenses: Credit cards can be used for everyday purchases, providing flexibility and convenience.

Building a Credit History: Responsible credit use helps you build a positive credit history, which can lead to better interest rates on loans and credit cards.

Credit Isn't All Bad! Used responsibly, credit can be a tool for building a good financial future.

Also, many people take advantage of rewards programs offered by credit cards, which give them cash back, travel points, insurance protections, and other benefits.

There are two main types of credit to know about.

Revolving Credit is just like a revolving door. You can borrow money, pay it back, and borrow again, up to a certain limit. Credit cards are the most common form of revolving credit.

Installment Credit is like a one-way door. You borrow a fixed amount of money and pay it back in regular installments over a set period. Examples include car loans and mortgages.

The Downsides of Credit

While credit can be a useful tool, it's important to use it wisely.

Misusing credit can lead to:

Debt: Overspending can lead to debt that's difficult to repay.

High-Interest Rates: Late payments or defaulting on loans can result in higher interest rates.

Damaged Credit Score: Poor credit habits can negatively impact your credit score, making it harder to borrow money in the future.

Credit is a powerful tool, but it must be used responsibly.

By understanding how credit works and using it with intention, you can improve your financial well-being.

I hope this all makes a lot of sense to you!

And, now that we’ve had a credit basics crash course, let’s talk about HOW we find out what our credit is actually looking like.

Stop here if you have not already done your pre-homework:

>> Click here to grab your right-now free credit score courtesy of me and SoFi <<

You need it because it’s time to learn about credit reports and credit scores!

2. Credit Report vs. Credit Score: What's the Difference?

Imagine your credit report is like your full financial report card. It's a detailed record of your borrowing history, showing how well you've managed credit in the past.

It includes:

Personal Information- Name, address, Social Security number

Credit Accounts- Credit cards, loans, and mortgages

Payment History- On-time or late payments

Credit Inquiries- When lenders check your credit

Public Records- Bankruptcies or foreclosures

On the other hand, your credit score is like your overall grade. It's a number that summarizes the information on your credit report. Think of it as a snapshot of your financial health.

Why Do They Matter?

Lenders use your credit score to determine your creditworthiness.

A good credit score can help you qualify for loans, credit cards, and even jobs.

Understanding your credit report and score can also help YOU make informed financial decisions.

Let's break it down further.

Think of your credit report as a book.

Each chapter tells a story about your financial habits…

[Chapter 1] Payment History (35% of your score): Are you a punctual payer or a late fee collector?

[Chapter 2] Credit Utilization (30% of your score): How much of your available credit are you using?

[Chapter 3] Length of Credit History (15% of your score): How long have you been managing credit?

[Chapter 4] Types of Credit (10% of your score): Do you have a mix of credit cards, loans, and mortgages?

[Chapter 5] Credit Inquiries (10% of your score): How often do you apply for new credit?

Your credit score is the final grade for this book. A good score means you're a reliable borrower.

A poor score might mean you'll face higher interest rates or even be denied credit.

Remember that your credit score is a snapshot in time. By understanding your credit report and making smart financial decisions, you can improve your score and achieve your financial goals.

Sidebar: Three major credit bureaus in the United States collect and store your financial information for review by lenders (and you). They are Equifax, Experian, and TransUnion.

By law, you are entitled to at least one free credit report per year from each of the three credit bureaus. Click >> HERE << to get yours.

Now that you have both your credit score and credit reports in hand (right?), let’s cover some ways to GROW your score!

3. Ways To Boost Your Score

1.Clean Up Your Credit Report:

A clean credit report is essential for a healthy financial future. Errors on your credit report can negatively impact your credit score, making it harder to get approved for loans, credit cards, and even jobs.

Here’s what to look for in each section.

Personal Information: Ensure your name, address, and Social Security number are correct.

Accounts: Verify the accuracy of all your credit accounts, including credit cards, loans, and mortgages.

Payment History: Check for any errors in your payment history, such as late payments or incorrect balances.

Public Records: Review any public records, such as bankruptcies or foreclosures, to ensure accuracy.

Inquiries: Check for unauthorized credit inquiries, as these can negatively impact your credit score.

2.Dispute Errors:

If you find any errors on your credit report, you can dispute them with the credit bureau. Here's how:

Gather Your Documentation: Collect any evidence that supports your claim, such as receipts, canceled checks, or bank statements.

File a Dispute: Submit a dispute to the credit bureau, clearly stating the error and providing supporting documentation.

Need help?

>> CLICK HERE FOR THREE FREE SAMPLE DISPUTE TEMPLATES <<

Monitor Your Credit Report: Keep an eye on your credit report to ensure the error is corrected.

DISPUTE PROCESS PRO TIP- While you can often dispute items online, consider mailing your dispute letter. This provides a physical record of your dispute and can help you track its progress. Additionally, it can prevent any potential misunderstandings or unintended agreements that may arise from online disputes.

3.Reduce Debt:

Debt can be a major drag on your financial health. Not only does it stress you out, but it can also negatively impact your credit score.

Remember we talked about credit utilization and how it makes up 30% of your score?

You want to keep the balance on your credit card as close to $0 as possible.

The closer your balance (amount owed) is to your credit limit, the higher the ding to your credit score.

There are two main ways to attack your debt - the Avalanche and Snowball methods.

Avalanche Method:

You prioritize paying off high-interest debt first.

This method can save you money in the long run by reducing interest charges.

Example: If you have a credit card with a 20% Annual Percentage Rate (APR) and a personal loan with a 10% APR, you would focus on paying off the credit card first.

Snowball Method:

Pay off the smallest debt first, regardless of interest rate.

This method can provide a sense of accomplishment and momentum.

Example: If you have a $500 credit card debt, a $1,000 car loan, and a $5,000 student loan, you would focus on paying off the $500 credit card first.

My suggestion is to mix the two methods so that you see small and big successes.

This means starting with the Snowball Method to pay off some of your smaller debts first for quick wins, and then shifting to the Avalanche Method when it makes sense.

3.5 Dream Catcher High-Five ✋🏿: Janelle ~ 50+ Point Credit Score Boost (Under 1 Year)

Ready to get inspired? Take a break from scribbling in your notebook for a super quick motivation boost. Learn how Janelle was able to get good with credit and debt... and the positive impact it had on her life!

4.Credit Limit Increase Request

Want to boost your credit score? Requesting a credit limit increase can help. By increasing your credit limit, you can lower your credit utilization ratio, a key factor in your credit score.

To request a credit limit increase, contact your credit card company and politely explain why you want a higher limit. There's no harm in letting them know that you're considering ways (in addition to extra payments) to positively impact your credit utilization and allow room for growth on the card for future needs.

Be sure to emphasize your positive payment history and financial stability (if applicable).

IMPORTANT NOTE: Make sure to ask if they can do an internal account review and/or check in a way that DOES NOT impact your credit score (i.e. a soft pull). If they indicate they need to run a full credit check, you are free to decline from proceeding.

An internet search on your credit card(s) may give you a hint at what's possible when it comes to credit limit increases. For example, typing in your search bar "Will X credit card do a soft pull for a credit limit increase?"

Remember, a higher credit limit comes with greater responsibility. Use it wisely.

5.Credit Builder Loan

A >> credit builder loan << is a unique financial tool designed to help individuals with limited or damaged credit establish a positive credit history.

Unlike traditional loans, credit builder loans often don't require a credit check, making them accessible to those with poor or no credit.

By making regular payments on your loan, you can establish a positive credit history and boost your credit score over time.

6.Secured Credit Card

A secured credit card is a type of credit card that requires a security deposit.

This deposit secures your credit limit, ensuring responsible usage. By making timely payments on your secured credit card, you can establish a positive credit history and gradually improve your credit score.

Once you've demonstrated responsible credit behavior, you may be eligible to upgrade to an unsecured credit card.

Are you struggling to build (or rebuild) your credit?

Stop here and >> click on my favorite tool for DOUBLING your credit-boosting << potential.

Start with their Credit Builder Account—no credit check needed!—and make manageable monthly payments (starting at $25) that are reported to all 3 credit bureaus. This establishes positive credit history and builds your savings.

Then, after 3 on-time payments and meeting other eligibility requirements, unlock access to their secured credit card to continue building your credit even faster.

>> READ ABOUT IT HERE <<

SIDEBAR: Now that you're an expert on credit, it's important to do your best to protect yourself from credit card fraud!

Scammers use tactics like phishing emails and skimming devices to steal your information.

Be cautious online, avoid public Wi-Fi for financial transactions, monitor your accounts regularly, and consider a credit monitoring service for added protection.

✨ 4. BONUS (100 Points Hack!)✨

Now I’m going to show you one of my favorite tactics that (in combination with the other tactics we’ve discussed so far) can make your credit score jump like Jordan… Michael, that is.

In fact, adding this strategy to your toolbelt can raise your credit score as much as 100 points in a year.

Yup, I said it!

5. VIDEO BREAK 🍿🥤

Please pause here to watch me break down the 'Jump Like Jordan' credit-boosting method... and drop the info on a game-winning play for your financial future.

Here's the 'Jump Like Jordan' method on paper…

1.Grab a Card with a Zero Balance: Locate a credit card with no annual fee and a $0 balance. Existing card work too! If you're new to credit or have a limited history, consider the secured card we just talked about. Applying for a card can cause a temporary credit report inquiry, but the long-term benefits outweigh the short-term dip.

2.Charge a Small Recurring Bill: Choose a small, recurring bill like a phone bill or streaming service. This is the only charge you'll put on this card.

3.Set Up Auto-Pay Hero Mode: Automate a payment from your bank account to pay off the ENTIRE balance of the card every month. This creates a "payoff loop" and keeps your credit utilization ratio low (a big factor in credit scores).

Don't swipe this card for anything else! Leave it at home to avoid temptation.

You'll be surprised how quickly consistent, automated payments can improve your credit score!

Whew now take a deep breath. Inhale. Exhale. Because we covered a whole lot…

You should feel confident in your basic credit knowledge, ready to take steps to improve your credit score, and excited about maintaining a strong financial future. *high five*

6. Learn About The Get Good With Money Plan

What a day, right? You've just scratched the surface of the credit world.

We haven't even touched on powerful strategies like Goodwill Letters to clean up your credit report and smart debt restructuring to save serious cash.

But don't worry, I’m not going to leave you hanging.

I've created an immersive video training experience and a supportive community of like-minded students, experts and financial advisors to keep us informed and accountable.

Together, we'll dive deep into my 10-Step Financial Wholeness Plan.

From budgeting to investing, retirement, and beyond, we'll cover it all.

And to celebrate your commitment to financial growth you showed by joining the Get Good With Money Challenge, you get 40% OFF our comprehensive Financial Wholeness plan.

You are putting in the WORK and that means you get special privileges (a.k.a. favoritism)!

Let's work together to achieve your goal.

Ready to join us on the journey to becoming financially whole?

And, please share your biggest takeaways from today's credit lesson in our >> private group <<. Let's celebrate your progress together!

7. Don't forget we have a live hangout session tonight at 8PM ET HERE.

Link not working? Copy and paste this: https://www.youtube.com/watch?v=9sgtiApsLYw

Live richer,

Tiffany

FOLLOW US ON SOCIAL

My Lisa Rule: I have 4 sisters and Lisa is the baby (well she’s not a baby anymore). Of all of my sisters, I’m the most protective over her. Before I share any product or service with you, it must pass my Lisa Rule.

What’s the Lisa Rule? If I would not advise Lisa to use a product or service, I won’t advise you to either. YOU are my Lisa's. I feel protective over you and your financial journey.

The products and services I recommend pass my Lisa Rule. Yes, I may be an affiliate or partner and earn a commission off of referrals or income, but I would not recommend a product or service that I didn’t believe was helpful and useful.

FOLLOW US ON SOCIAL

TOOL OF THE DAY

SoFi Credit Score

Grab free credit score tracking, monitoring, and insights.